| | |

The column on the left is Thinking

Biblically about the Banking Crisis from the blog Between

Two Worlds. The column on the right is a Vine

& Fig Tree response. |

| David

Kotter is the Executive Director of The Council on Biblical Manhood and

Womanhood. I've found him to be a reliable, insightful voice on the intersection

of theology and economics. He has an MBA, has taught economics, served as a

finance manager for Ford Motor Company, and has done a lot of thinking on the

topic. So I decided to ask him a few questions in an attempt to think biblically

about the banking crisis that is currently underway. |

Kevin Craig is the

founder of of Vine & Fig Tree.

He has an MA and a JD. He passed the California Bar

Exam but was not given a license to practice because he refused to give

unqualified allegiance to the government, reserving ultimate allegiance to God. More

on the case. More on the author.

More on his views on economic issues. |

| What

is happening in the present banking crisis? |

I object to the academic, neutral

language: "the banking crisis." Calling something a "crisis"

is loading the issue in favor of government assistance. This is actually something

that was caused by "government assistance." "Banking

crisis" makes it sound as if something is happening to

the banking system, rather than because of the banking system. And

it's not really a result of what most people used to call "banking,"

that is, storing money from depositors and never loaning out more than savers have

deposited in the bank. A married man who visits a prostitute and picks up a few

STD's doesn't have a "marriage crisis." Marriage isn't his problem, and

marriage didn't cause his pain. |

| Last night the federal government

committed to lend $85 billion to the insurer American International Group (AIG),

on top of the $200 billion of capital promised to keep Fannie Mae and Freddie Mac

solvent in July and $30 billion for Bear Stearns in March. In

other words, more than $1,000 for every man woman and child in the country has

been directed in various ways to resolve the

present banking crisis. At this point, you might be wondering why this

happened and what benefit you can expect to receive from your thousand-dollar

share. |

| Why is this happening? |

- Why is what happening? Do you mean,

- "Why is the government taking

an average of $1,000 from every man, woman, and child in America and giving

the money to rich Wall Street Bankers?"

- Why is that happening? Because Wall St. Bankers have a lot of

influence in Washington D.C., that's why. More accurately, Washington D.C. is

bankers. Henry

Paulson, Secretary of the Treasury who has arranged to take $1,000 from

each American and give the money to Wall St. Bankers, previously served as the

Chairman and Chief Executive Officer of Goldman

Sachs, one of the world's largest and most successful investment banks.

Bill Clinton's Treasury Secretary, Robert Rubin, was Co-Chairman and Co-Senior

Partner of Goldman Sachs. Prior to the Clinton Administration, Wall Street had

loaned billions of dollars to Mexico, probably thinking it was a sure bet

because Mexico had the power to tax the Mexican people to pay back the loans.

But raising taxes is politically dangerous, so Mexico threatened to default on

the loans made by Wall Street. The Bankers in Washington tried to convince

Congress to "bail out Mexico" (which, of course, means bailing out

Wall Street), but Congress

balked. So the Goldman Sachs representative at the Treasury Dept., Robert

Rubin, used the "Exchange Stabilization Fund" to bypass Congress and

the Constitution, sending billions to the bankers. The ESF was one of many

projects nursed during the New Deal by Harry Dexter

White, a

communist agent.

|

|

|

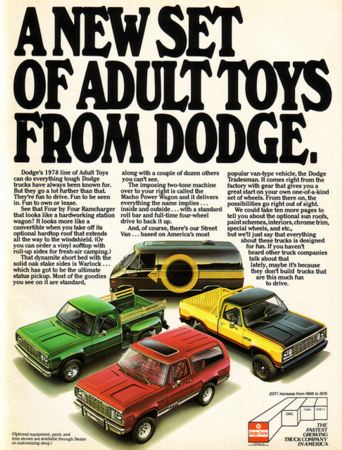

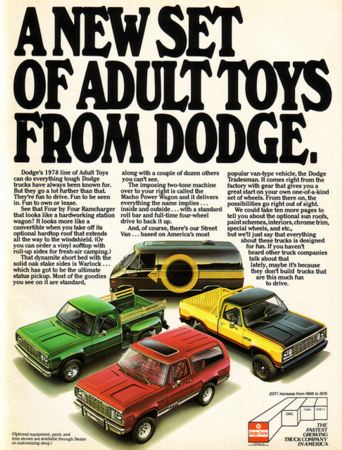

Little girl gets ears pierced

to become "big girl." |

|

|

Little boy gets new toys

to become "big boy." |

|

- Or do you mean,

- "Why do the American people

allow the government to take an average of $1,000 from every man, woman, and

child in America and give the money to rich Wall Street Bankers?"

- Why is that happening? Because the American people want to be

the slaves of bankers. They believe that if something bad happens to the

bankers, they won't be able to buy their SUV's and HDTV's. They have been

brainwashed into believing that if the government doesn't bail out the

bankers, the "Money

Machine" will "grind to a halt" and

they won't be able to buy their "adult toys."

"The rich ruleth over the poor, and the borrower is slave of the

lender."

Proverbs

22:7

"But suppose the slave should say, 'I love my master and my wife and

children—I don't want my freedom,' then his master is to bring him before God

and to a door or doorpost and pierce his ear with an awl, a sign that he is a

slave for life."

Exodus 21:2-6

|

- There are plenty of root causes for the present crisis, depending on whom

you ask and where you look.

- • Some point to the several years of artificially

low interest rates from the Federal Reserve Bank. These led to an

explosion of home building and enabled families to stretch into larger houses.

|

Interest rates should be higher. This is

another reason "why this is happening." Borrowers want low interest

rates. Lenders want low interest rates to attract more borrowers. In a culture

such as ours, where there are lots of people wanting to borrow money now,

and few people who are saving

their money for the future, interest rates should be high. It's the law of

supply and demand: a large demand for a small supply = high prices.

"Interest rates" are the price of borrowed money.

In the past, savers deposited their money with the bank to be paid interest,

and the bank would loan the savings at a higher rate of interest to make a

profit on the difference paid back to depositors. But there

are no depositors anymore; everyone is spending, not saving. When borrowers

approach lenders, lenders should be saying, "Sorry, nobody has saved any

money for me to lend to you." But the bankers, who have taken over the

government, have a nice arrangement. They skip the depositors. When a borrower

comes to a bank, the bank creates a deposit for the borrower. Out of thin

air, not out of someone else's saved funds.

Let's look at a statement or two from a book published by the Federal Reserve

Bank of Chicago (a branch of the U.S. Central Bank), entitled, Modern

Money Mechanics: A Workbook on Deposits, Currency and Bank Reserves.

The actual process of money creation takes place in commercial banks. [D]emand

liabilities of commercial banks are money. These liabilities are customers'

accounts. They increase when the proceeds of loans made by the banks are

credited to borrowers' accounts.

Banks can build up deposits by increasing loans and investments.

Expansion [inflation] takes place only if the banks . . . increase their

loans or investments. Loans are made by crediting the borrower's deposit

account, i.e., by creating additional deposit money.

Expansion continues as the banks . . . increase their loans . . . crediting

borrowers' deposits - creating still more money - in the process.

There is nothing "conspiratorial" here. The Feds (the Federal

Reserve System) have nothing to hide. The System was created precisely to

manipulate the money supply and allow the government to buy the things it wants

- including the votes of the middle and upper classes - by giving "the

People" the power to buy the things they want - "at low, low,

interest."

And the most important fact to remember: every act of "credit

expansion" which is undertaken by borrowing, is an act of currency

debasement, making every other dollar held by everyone else worth less -- an act

of creating false weights. It is an abomination to God.

- "Low interest rates" removes the problem from its

cause. Interest rates were lowered by the government by creating new money out

of thin air.

- The root cause of our problems is the debasement of the

currency, false weights and measures, or fractional reserve banking, all

of which are phrases which describe the same root cause.

|

- • Others blame lenders for creatively introducing no-documentation and

interest-only loans as a temptation to over-extended buyers. There

is certainly individual responsibility involved whenever anyone signs the

imposing mortgage document packet.

- • In any case, many people borrowed money to purchase houses and this

increase in demand increased the price of houses.

|

- A second root cause is the willingness of borrowers to make

commitments they can't or won't keep:

- "The wicked borroweth, and payeth not again" Psalm

37:21

The final root cause of the "banking crisis" is the

willingness of bankers to use the powers of the government to confiscate money

from utterly unrelated, innocent parties to avoid the consequences of the bad

loans they made. This confiscation comes from threats

of violence or fraud which hurts

the poor the most. Even if 51% of the People are borrowers and want to use

the government to take money from the 49% who do not, the bankers should not

accept the money.

|

| At the most basic level, a $100,000

mortgage loan on a house (at 6%) is a promise to pay back about $215,000 over the

next 30 years in 360 convenient payments. This

promise is obviously valuable to a commercial bank, and can be sold to other banks

or even consolidated and sold to large investors as a Mortgage-Backed Security (MBS).

If the promise is not kept, the lender gets the house to offset the decreased

value of the promise. |

Everyone who uses a mortgage to buy a home pays

the bankers more in interest than the house is worth.

For a good (funny as well as morally incisive) explanation of

"structured" or "consolidated" debt, see the video at the

bottom of this

page.

|

| Problems

arose last year when many people failed to keep their mortgage promises. This year

a staggering 25% of all subprime loans are delinquent or in foreclosure. In

essence, the valuable promises that were being bought and sold are now worth much

less. Further, the houses backing the promises are often worth much less because

so many are being sold at distressed prices. |

- Problems for whom? Suppose I invest all my money in a

horse-and-buggy factory, and horse-and-buggies turn out not to be

profitable. Is this your problem? Is it the problem of every

man, woman and child in America? Suppose I loan my money to someone with the

following profile:

- • Two or more loan payments paid past 30 days

due in the last 12 months, or one or more loan payments paid past 90 days due

the last 36 months;

- • Judgment, foreclosure, repossession, or

non-payment of a loan in the past;

- • Bankruptcy in the last 7 years;

- • Relatively high default probability as

evidenced by, for example, a credit score of less than 620 (depending on the

product/collateral), or other bureau or proprietary scores with an equivalent

default probability likelihood.

- Is this your problem? If I did a dumb thing by loaning to such

a person, should you be forced by the government to reward me?

To teach me the lesson that I can make stupid judgments with no consequences?

Should I be rewarded ("bailed out") by you for taking a risk

and lacking a shrewd business sense? Or should I be forced to eat my losses

and learn a valuable lesson?

|

| Therefore someone has lost a

lot of money (a.k.a. a crisis). The mortgage promises are no longer worth

what banks paid for them and the underlying real estate is often worth less than

the loans. Precisely, the real problem was that the risk of default was

underpriced, or not completely [taken]

into account by insurers and purchasers of mortgage-backed securities. Now

that the default rate turned out to be much higher than credit scoring agencies

predicted, the key question is who will

ultimately bear the cost of these multibillion-dollar losses. |

Who should be rewarded or penalized for not

taking something into account?

Looks like the answer to this last question is: You and I should be penalized,

and the banks -- the guilty party -- should be rewarded.

|

| Certainly the shareholders of

investment banks like Merrill Lynch, Bear Stearns, and Lehman Brothers have

realized tremendous losses. This has forced these companies into bankruptcy or

distressed sales to other firms. The shareholders of Fannie Mae and Freddie Mac

lost almost all of their equity when these government sponsored enterprises were

forced into conservatorship by the government. AIG, which sold insurance against

the risk of default of mortgage backed securities, gave up 80% of the firm to the

US government in exchange for a two-year loan at 11% interest. |

What responsibility do investors have to put

their money in businesses that are not ultimately dependent on theft, fraud, and

widespread bad character? |

| This is where your thousand dollar

contribution enters the picture: it represents your share of the government

bailout to partially offset these losses and keep most of these firms afloat. If

they all fail, the borrowing and lending that efficiently

directs capital in a modern economy will

grind to a halt. If none of them fail, the Federal Reserve will

introduce a "moral hazard"

that will reward risky behavior and

encourage more in the future. This is a good reason to intercede for “those

in authority, that we may live peaceful and quiet lives in all godliness and

holiness” (1 Timothy 2:1). |

- Lenders who lend to people who default are bad managers of our capital.

Their business needs to "grind to a halt" until wiser, more

efficient lenders fill the gap. Congressman Ron Paul, leading critic of

Fractional Reserve Banking and government-subsidized GSE's,

said the following in a speech

on September 10, 2003:

- One of the major government privileges granted to GSEs is a line of credit

with the United States Treasury. According to some estimates, the line of

credit may be worth over $2 billion. This explicit promise by the Treasury to

bail out GSEs in times of economic difficulty helps the GSEs attract investors

who are willing to settle for lower yields than they would demand in the

absence of the subsidy. Thus, the

line of credit distorts the allocation of capital. More

importantly, the line of credit is a promise on behalf of the government to

engage in a huge unconstitutional and immoral income transfer from working

Americans to holders of GSE debt.

The connection between the GSEs and the government helps isolate the GSE

management from market discipline.

Ironically, by transferring the risk of a widespread mortgage default, the

government increases the likelihood of a painful crash in the housing market.

This is because the special privileges granted to Fannie and Freddie have

distorted the housing market by allowing them to attract capital they could

not attract under pure market conditions. As a result, capital is diverted

from its most productive use into housing. This reduces the efficacy of the

entire market and thus reduces the standard of living of all Americans.

- Lending will only "grind to a halt" until new lenders who

take everything into account rise up and fill the void. Those

who don't do a very good job "efficiently directing capital" will

get jobs as greeters at WalMart. This is exactly what

needs to happen. The sooner this happens, the less capital will be

mis-directed, and the easier the re-adjustments will be.

|

| By the way, you won’t receive a

personal invoice for the thousand dollars; it will just be added to the national

debt. Ironically, for many people this is larger than the stimulus payment sent

out earlier this year, and there is no guarantee that the taxpayers won't be asked

contribute yet more as the crisis unfolds. |

The government will create your $1,000 out of

thin air and give it to the Wall Street risk-takers. These bankers will go to the

store and buy Kellogg's Corn Flakes that they otherwise could not have afforded.

This will bid up the price of Corn Flakes. You will have to cut your consumption

by a box of Corn Flakes. The Bankers will also buy a bar of Dial Soap with the

money they get from the government printing presses. You will not. You will have

the same number of "dollars," but you will lose $1,000 in purchasing

power because it has been transferred to the Bankers. They believe it's better for

them to have breakfast than you. And they run the government. |

| What

effect will this have on the wider economy? |

|

| Undoubtedly this crisis is having

widespread effects on the economy, although economists disagree as to the extent

at this point. AIG is one of the 30 stocks in the Dow industrials, so the

evaporation of the equity in this company was a major contributor to the 500 point

drop in the market on Monday. Investors are now suspicious of other banks, leading

them to sell those stocks as well. Banks are increasingly reluctant to make

mortgage loans and this makes it more

difficult for individuals to purchase a house. A huge inventory of houses

on the market in many areas is resulting in neighborhood blight and further

depresses prices. Individuals whose houses are declining in value are curtailing

other large purchases, and this further weakens the economy. High gasoline prices

and a weaker dollar only contribute to the malaise. |

What makes it difficult for people to buy a

house is the fact that they don't save any money, but spend it on consumer goods.

It is also more difficult to buy a house if the government takes more

than half of everything you earn in taxes. Bankers

are willing to pay these exorbitant taxes because they get bailed out. The rest of

us are willing to pay these taxes because the government is Santa Claus and will

give us a low-interest, fixed rate loan for new house, even though we have a bad

credit rating because we don't always pay our bills for our big houses or our new

HDTV and SUV. |

| On the other end, we must keep this

in a wider perspective. Though some laugh when they hear "the fundamentals of

the economy remains strong," this is actually true. For example, the

unemployment rate has risen to 6.1% (which is a challenge if you have personally

lost a job), but this rate is still lower than the peak in 2003 and is better than

many European countries today. Further, despite the rampant media discussion of a

recession, the economy has been growing for the last two quarters. This bubble,

like the “dot com” bubble and even the tulip mania bubble of 1637, will

eventually be resolved as banks and investors accurately report

their losses and adjust accordingly. |

Why is it the bankers don't have to

"adjust?" Why must they be bailed out with OUR money? Millions of

Americans should be required to "adjust" when they don't have the money

they want to buy the things the TV says they must have. |

| What

effect will this have on individuals? |

|

| For believers, this is just one more

reason to "not love the world or the things in the world" which is

"passing away along with its desires" (1 John 2:15, 16). In Louisville

we have been without electricity since Sunday, and it makes me increasingly

grateful that our God is independent and powerful enough to accomplish his good

will every moment. Lighting candles each night reminds me that I am not! |

This Bible passage is employed ambiguously. That

which is "in the world," according to the Bible, boils down to "archism."

But loving salvation, blessings,

Eden, and limitless

wealth is not a sin. People who are dependent on electricity to heat and cool

their homes or who are in the hospital have been known to die when the power goes

out. This is not a time to light a candle; it is a time to take action to prevent

even our candles from being taken from us by a power-hungry government. |

| Although it will be harder to obtain

aggressive mortgages, Christians who are

practicing prudent financial stewardship (modest houses, large down

payments, monthly payments easily within their means, diligent participation in

the work force) should not have much

problem. Everyone will want to verify that their savings account is

government insured, but believers with a generous "wartime mindset"

should have no trouble keeping their bank accounts under $100,000 FDIC limit.

Above all, don't be anxious about your life, what you will eat or what you will

drink, nor what you will wear. Remember that journalists, markets, and lemmings

tend to move in herds. The media never reports on thousands of planes that land

safely, but solely focuses on one that doesn't. In that light, if you are saving

for retirement more than 10 years from now, this actually would be a good time to

invest in the stock market. But don't let your IRA be a substitute god or distract

you from treasuring Jesus Christ (Matthew 6:24-34). |

In other words, the imprudent are being rewarded (bailed out). What lessons

does this teach?

Some

are not quite as optimistic about the stock market. The same government-created

money that inflated the housing market has inflated the stock market.

|

| Is it

right to pray for the economy? |

|

| I think it is appropriate to pray for

the economy. After all, God said to Jeremiah, "Seek the welfare of the city

where I have sent you into exile, and pray to the Lord on its behalf, for in its

welfare you will find your welfare" (Jeremiah 29:7). When the economy is

strong, people are able to work and support their families, believers have greater

opportunities for generosity, and many benefit from this common grace. |

|

| We can pray for integrity and wisdom

for government officials who are faced with the incredibly

complex task of regulating investment securities and banks in a way that is

transparent and serves all of the varied stakeholders. We

can pray that those who are willing to work will be able to find gainful

employment. We can pray that greed would be restrained at all levels, from

the leaders on Wall Street to individual families tempted to live beyond their

means. We can pray for ourselves that we will participate in the national

economy that keeps in mind the time is short and the present form of this world is

passing away (1 Corinthians 7: 29-31). |

"We the People" did not give the

federal government power to regulate banks. The Constitution certainly does not

give the banks (Henry Paulson, Robert Rubin) power to "regulate" (bail

out) themselves using our money.

We should definitely pray that the needed shift from socialism to a Free Market

will be as smooth as possible.

We should not be expecting the end of the world. www.NotComingSoon.net

|

| Many

thanks to David for taking the time to answer these questions! |

Postscript: The claim is not being made that

bankers run the entire government. Only that they run that part of

government dealing with banks. Just like other businesses that run other parts of

the government that ostensibly regulate their industry. The most powerful leaders

in an industry are those who set up regulatory bodies within government in order

to protect their market share against competitors, and use government to protect

or subsidize their business.

|

|

|

|